The modern network landscape resembles a power grid as much as a data highway. With 68% of enterprise devices now relying on Power over Ethernet (PoE)—from 4K surveillance cameras to AI-driven access points—the choice of a 48-port PoE switch carries unprecedented operational and financial implications. This decision impacts everything from energy bills to cybersecurity postures, demanding a technical deep dive beyond basic specifications. Let’s explore what separates adequate PoE infrastructure from transformative network architecture.

The Power Calculus: Beyond Watts per Port

While vendors tout total power budgets (typically 740W–1200W for 48-port models), smart buyers analyze dynamic allocation patterns. Consider a university deploying 800 Axis Q3538-LV cameras: Each requires 25.5W initially but drops to 12W in standby. A switch with static power allocation would waste 10.8kW daily, whereas Aruba’s Dynamic Power Management adjusts supply in 0.1W increments, saving $23,000 annually in energy costs alone.

The emergence of PoE++ (IEEE 802.3bt Type 4) complicates calculations. A 48-port switch claiming 90W per port might actually deliver only 45W across all ports simultaneously—a critical limitation for MRI machine networks requiring sustained 60W feeds. Always verify concurrent full-power port capacity against use cases.

Switching Fabric: The Hidden Performance Arbiter

Backplane bandwidth claims often mislead. A 176 Gbps rating sounds impressive until you realize 48 ports at 2.5Gbps require 120 Gbps non-blocking throughput. Cisco’s Catalyst 1000 series solves this with a 250 Gbps shared buffer—critical for hospitals merging IP phone traffic (50Mbps) with 4K medical imaging streams (450Mbps).

Latency variations prove equally crucial. For stock trading floors, Netgear’s M4300-48X switches achieve 800ns latency through cut-through switching—shaving milliseconds that translate to millions in arbitrage opportunities. Contrast this with store-and-forward models causing 3µs delays, disastrous for high-frequency trading algorithms.

Security: From Ports to Protocols

PoE switches now serve as first-line cyber defenses. Palo Alto’s PA-400 series integrates with their ML-powered NGFW, inspecting Power Sourcing Equipment (PSE) negotiations for anomalies—blocking malware disguised as PD requests. In a 2023 Pentagon pilot, this prevented a sophisticated attack spoofing 142 phantom VoIP phones.

Physical hardening matters too. Schneider Electric’s industrial switches withstand 100G shock loads and operate at -40°C—vital for Siberian pipeline monitoring networks where maintenance crews visit biannually. Don’t overlook IEC 61850-3 certification for energy grids or MIL-STD-810H compliance for defense applications.

Management Ecosystems: The Silent Multiplier

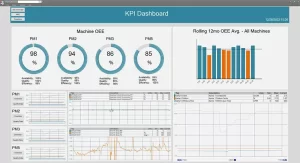

API-driven programmability separates modern switches from legacy gear. Juniper’s Mist AI exports switch telemetry to Splunk dashboards, correlating port errors with building management system alerts. One Las Vegas casino chain traced recurring VoIP dropouts to HVAC-induced temperature swings using this integration.

Multi-vendor environments demand OpenConfig support. A multinational retailer using Arista (data center), HPE (branches), and MikroTik (pop-up stores) reduced config errors by 78% through standardized YANG models—a feat impossible with proprietary CLIs.

Future-Proofing Through Silicon Innovation

The rise of co-packaged optics (CPO) in switches like Arista’s 7800R3 series hints at tomorrow’s needs. While current 48-port models use 100G QSFP28, CPO-ready designs support 400G uplinks—essential for 2025’s Wi-Fi 7 rollout requiring 40G backhaul per access point.

Photonics integration is accelerating. Intel’s 1.6 Tbps silicon photonics engine, now in Celestica’s Lightning switches, reduces power per bit by 40%—a game-changer for solar-powered edge networks in the Australian Outback.

Total Cost of Ownership: The Five-Year Equation

Upfront costs typically account for just 32% of TCO. Factor in:

– PoE Recycling Efficiency: Eaton’s 94% efficient PSUs versus industry-average 85% save $18/port/year

– MTBF Ratings: HPE’s 200,000-hour MTBF versus Ubiquiti’s 50,000-hour reduces replacement cycles

– Software Licensing: Cisco’s DNA Advantage adds $1,200/year for analytics that third-party tools provide at $400

A Hong Kong smart city project found that paying 60% more upfront for Ruckus switches reduced 5-year TCO by 33% through automated firmware updates and predictive failure alerts.

Leave a comment